Short Term Rentals and Access to Housing in Santa Fe

KELLY O’DONNELL, PH.D. | CHIEF RESEARCH AND POLICY OFFICER, HOMEWISE

FINDINGS:

The number of STRs in Santa Fe has increased markedly since 2014.

STR growth is slowing, suggesting that Santa Fe’s STR market is nearing saturation.

About 60 percent of Santa Fe’s 1,444 active whole-unit STRs are registered with the City.

Santa Fe’s 646 STR hosts earned $54 million from their Santa Fe properties in 2018, an average of over $80,000 per host per year.

Although 80 percent of hosts list only one STR property, over 100 Santa Fe hosts list two or more entire homes. The city’s top 15 hosts account for 381 active STRs, over one-quarter of the Santa Fe market.

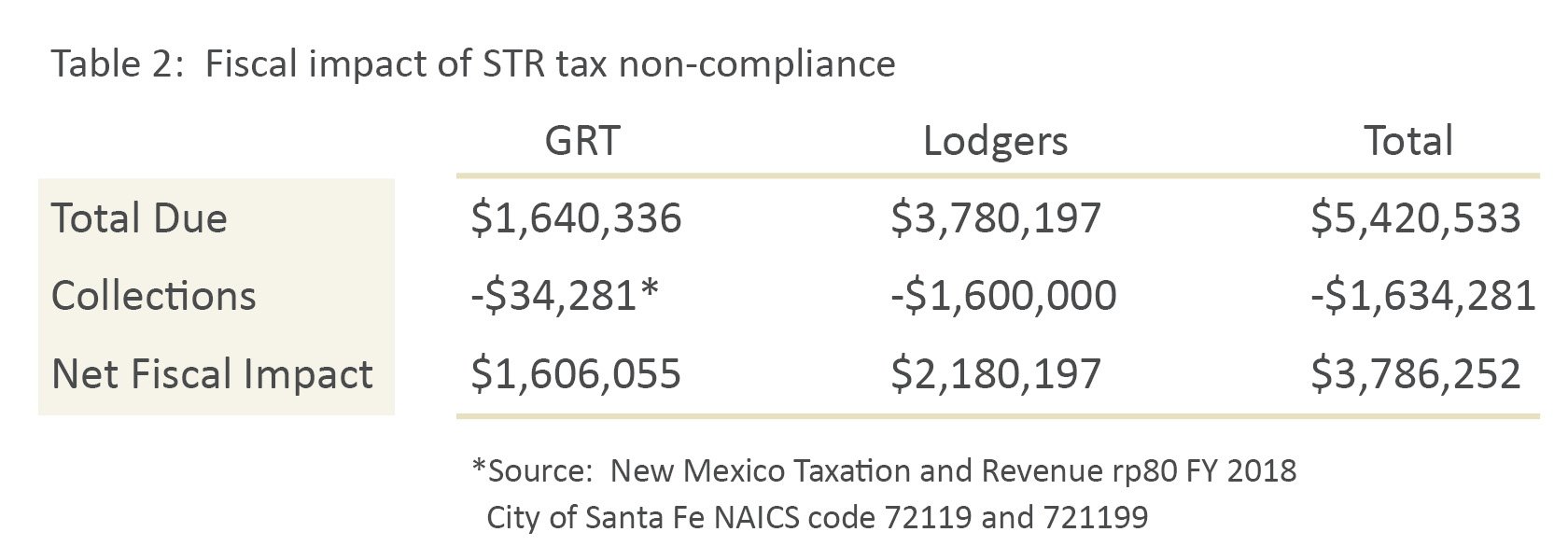

Non-compliance with the Lodgers and Gross Receipts taxes by STR hosts is costing the City of Santa Fe $3.8 million annually.

Non-compliance with the gross receipts tax, which appears to be almost universal among STR hosts, is costing the City $1.6 million each year.

Fifteen percent of single family homes listed on Santa Fe County’s tax rolls have owners who reside outside New Mexico. In central Santa Fe the percentage of absentee owners exceeds 20 percent. The city’s current STR registry does not include registrants’ primary address, thus it is difficult to determine how many STRs are ‘hosted’ by out-of-state entities.

Incentives to construct new Accessory Dwelling Units (ADUs) or use ADUs as long term rentals can help to increase Santa Fe’s housing supply, but such policies, even if very successful, can make only a small dent in Santa Fe’s profound shortage of affordable housing and must therefore be part of a larger package of housing reforms and investments.

RECOMMENDATIONS:

Enforce registration requirements. Ensure that all active STRs are registered with the City by actively seeking out unregistered properties and punishing non-compliance.

Educate STR hosts about their obligation to pay both the Lodgers Tax and the Gross Receipts Tax, even if the platform(s) on which they list their properties cannot, or will not, automatically collect and remit one or both taxes. The City can improve GRT compliance by requiring STR hosts to supply a CRS number at registration and advising hosts of the correct NAICS code under which to report their STR gross receipts. At the state level, rescinding property tax breaks for second homes can make taxes more equitable and generate additional revenue for affordable housing.

Invest in affordable housing. All additional revenue attributable to enforcement of the GRT and Lodgers tax should be dedicated to the City’s Affordable Housing Trust Fund. The City can take advantage of recent legislation de-earmarking certain local option gross receipts taxes to direct more gross receipts tax revenue to housing.

Reduce barriers to construction of affordable housing by:

Reducing costs associated with permitting, impact fees and water rights for affordable housing developers.

Revising zoning standards to eliminate conflicting requirements and encourage development of mixed-used affordable housing projects.

Streamlining the development approval process to expedite affordable housing approvals while ensuring adequate community input.

Reducing regulatory barriers to ADU construction.

Support state legislative proposals that fund affordable housing and promote tax fairness:

Limit the 3 percent cap on annual valuation increases to owner-occupied homes so that the property tax on vacation homes and STRs is based upon true market value and tax burden is distributed more equitably.

Authorize local governments to impose an occupancy surtax on STRs to fund affordable housing.

Lack of affordable housing is one of the greatest challenges facing Santa Fe in 2019. Recent proliferation of short term rentals (STRs) marketed on platforms like Airbnb has contributed to the rapid escalation of home prices and rents. Although additional regulation of STRs may be called for at some point, enforcement of existing regulations and taxes is a critical first step toward minimizing the impact of STRs on access to affordable housing. More vigorous enforcement of STR registration requirements and increased Gross Receipts and Lodger’s Tax compliance by STR hosts could generate as much as $3.8 million in annual revenue that the City could and should put toward affordable housing.

Short Term Rentals in Santa Fe

There are over 1,600 active short term rentals (STRs) in the City of Santa Fe. Ninety percent of the city’s STRs (1,444 units) are entire houses or apartments. Over half of Santa Fe’s whole-unit STRs are available all year, indicating that they serve solely as short-term rentals.

Figure 1:

Santa Fe city limits and zip code boundaries

Between December 2014 and December 2018 the number of whole-unit STRs increased 380 percent, climbing from roughly 300 to 1,444 (Figure 2).

Figure 2: Whole house/apartment STRs, Santa Fe 2014-18

Source: AirDNA (See: “Data Used in this Analysis” at the end of this report)

As of March 2019, the STR registry maintained by the City of Santa Fe listed 871 STRs, or about 60 percent of active whole-unit properties.

STR Hosts and Market Concentration

The 1,444 whole-unit STRs currently active in Santa Fe are operated by approximately 646 individual hosts. Although 80 percent of hosts list only one STR property, over 100 Santa Fe hosts list two or more entire homes. The city’s top 15 hosts account for 381 active STRs, over one-quarter of the Santa Fe market.

STR Revenue and Market Saturation

Santa Fe’s STR market generated over $54 million in revenue in 2018, an average of $83,591 per host.

STR rates are determined by supply and demand. When demand for a particular type of property exceeds supply, hosts can charge more. As the supply of STRs increases, competition among hosts drives prices down. Average daily revenue is thus one indicator of STR market saturation.

Despite recent dramatic increases in the number of STRs active in Santa Fe, average daily revenue continues to increase faster than inflation, indicating that Santa Fe’s STR market is maturing but has yet to reach saturation (Figure 3).

Figure 3:

STR average daily revenue by zip code

Source: AirDNA

Tax Collections

Non-compliance with the Lodgers and Gross Receipts taxes by STR hosts is costing the City of Santa Fe $3.8 million annually. Although Lodgers tax compliance has improved recently, the City is still collecting less than half of the revenue it appears to be entitled to. Non-compliance with the gross receipts tax, which appears to be almost universal among STR hosts, is costing the City $1.6 million annually.

Short term rentals are subject to Santa Fe’s 7 percent Lodgers Tax and the New Mexico Gross Receipts Tax, which currently totals 8.44 percent within the city limits.

Lodger’s tax is voluntarily collected and remitted to the city by some, but not all, short term rental platforms. In 2018 the City collected $1.6 million in lodgers tax from STRs, or about 42 percent of the tax due on $54 million in receipts.

Revenue from the gross receipts tax is shared by city, county and state governments. City local option tax increments account for 1.81 percentage points of the GRT and the state returns an additional 1.225 percentage points of GRT collections to the City in the form of a municipal credit, bringing the City’s share of the GRT collected within city limits to 3.04 percentage points, or 36 percent of total collections.

Although Airbnb voluntarily collects and remits Santa Fe’s Lodger’s Tax, none of the STR platforms currently collect New Mexico’s GRT. The lack of automated collections does not exempt STR hosts from GRT, but very few Santa Fe hosts appear to be paying the tax. In fact, review of data from the New Mexico Taxation and Revenue Department (TRD) indicates that Santa Fe STRs paid $95,225 in GRT in fiscal year 2018, about 2 percent of the $4.6 million in GRT due on $54 million in receipts.

Figure 4 shows the gross receipts tax due on $54 million in STR receipts by taxing jurisdiction. Full compliance with the GRT by STR hosts would generate $1.6 million for the City, over $800,000 for Santa Fe County and over $2 million for the State of New Mexico.

Figure 4:

Gross receipts taxes due on 2018 Santa Fe STR revenue

Table 2 shows the full fiscal impact on the City of Santa Fe of non-compliance with existing taxes by STR hosts. (1)

The estimate of foregone GRT is based on analysis of TRD’s Quarterly RP-80 reports, which provide data on taxable gross receipts by local government jurisdiction and industrial sector. TRD classifies businesses using six-digit North American Industry Classification System (NAICS) codes. Short term rentals fall under NAICS code 721199 which comprises “establishments primarily engaged in providing short-term lodging (except hotels, motels, casino hotels, and bed-and-breakfast inns).”

Sometimes taxpayers inadvertently report gross receipts under the wrong NAICS code. This is particularly true for taxpayers who engage in multiple types of taxable business activity. It is possible that some of the GRT revenue not showing up under 721199 is being reported under a different NAICS code.

Lodgers Surtax

State law earmarks all Lodgers Tax revenue for promotion of tourism. (2) Legislation considered by the 2019 New Mexico State Legislature (3) would have authorized the imposition of an occupancy surtax of up to 2 1⁄2 percent of the gross taxable rent on STRs. The new surtax would be added onto the lodgers taxes STR hosts are already required to pay, but the additional revenue would be dedicated to affordable housing

Impact on Affordable Housing

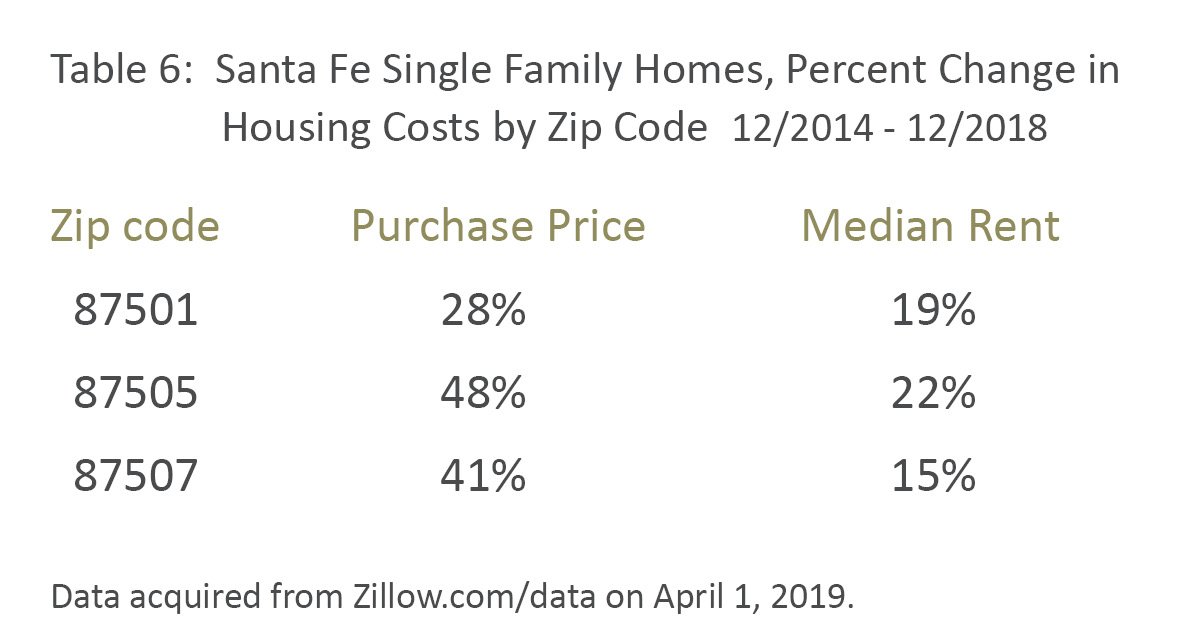

The conversion of houses and apartments into short-term rentals reduces the supply of housing, putting upward pressure on rents and home prices citywide. Since December 2014, the number of STRs in Santa Fe has increased by an average of 50 percent per year. During that same period, rents increased by an annual average of 4.9 percent and median home prices rose by an annual average of 10 percent. The extent to which STRs have contributed to the rapid escalation of Santa Fe’s housing costs is not known with certainty; but, based on results of a national study, it appears that about 20 percent of the city’s housing cost growth since 2014 can be attributed to the proliferation of STRs.

The immediate impact of STRs is concentrated in the areas of town most popular with tourists. Table 3 shows the supply of housing and the number of whole house/apartment STRs by zip code. Not surprisingly, Santa Fe’s STRs are clustered in the downtown area. Over 60 percent of STRs are located in zip code 87501. STRs also consume a far larger share of the total housing stock in 87501 than they do in either 87505 or 87507.

Also noteworthy are the large number of homes in 87501 and 87505 classified as ‘vacant.’ These houses are primarily second homes. (4) According to the Santa Fe County Assessor’s Office, 15 percent of single family homes listed on the County’s tax rolls have owners who reside outside New Mexico. In central Santa Fe the percentage of absentee owners exceeds 20 percent. The city’s current STR registry does not include registrants’ primary address, thus it is difficult to determine how many STRs are ‘hosted’ by out-of-state entities.

Property Tax Subsidies for Vacation Homes & STRs

Provisions of New Mexico’s property tax code originally intended to help low and moderate income homeowners stay in their homes now subsidize the purchase of second homes and STRs by out-of-state residents. In 2001, the State enacted a law prohibiting assessors from raising the valuation of residential property by more than 3 percent annually, provided that the property did not change owners. The law was intended to prevent long-time resident homeowners from being forced from their homes by high property taxes, however its provisions also apply to residential property that is not the owner's principal place of residence (e.g. vacation homes and STRs.) Limiting the 3 percent cap to primary residences has been suggested as a way to both decrease the property tax burden on state residents and raise additional funds that could be put toward affordable housing.

Figure 5 shows the growth in number of whole-unit STRs by housing type. Growth in the number of single family homes being used as STRs appears to be leveling off while the number of STRs in multifamily developments continues to increase rapidly.

Figure 5: Santa Fe whole-unit STRs by type

Source: AirDNA

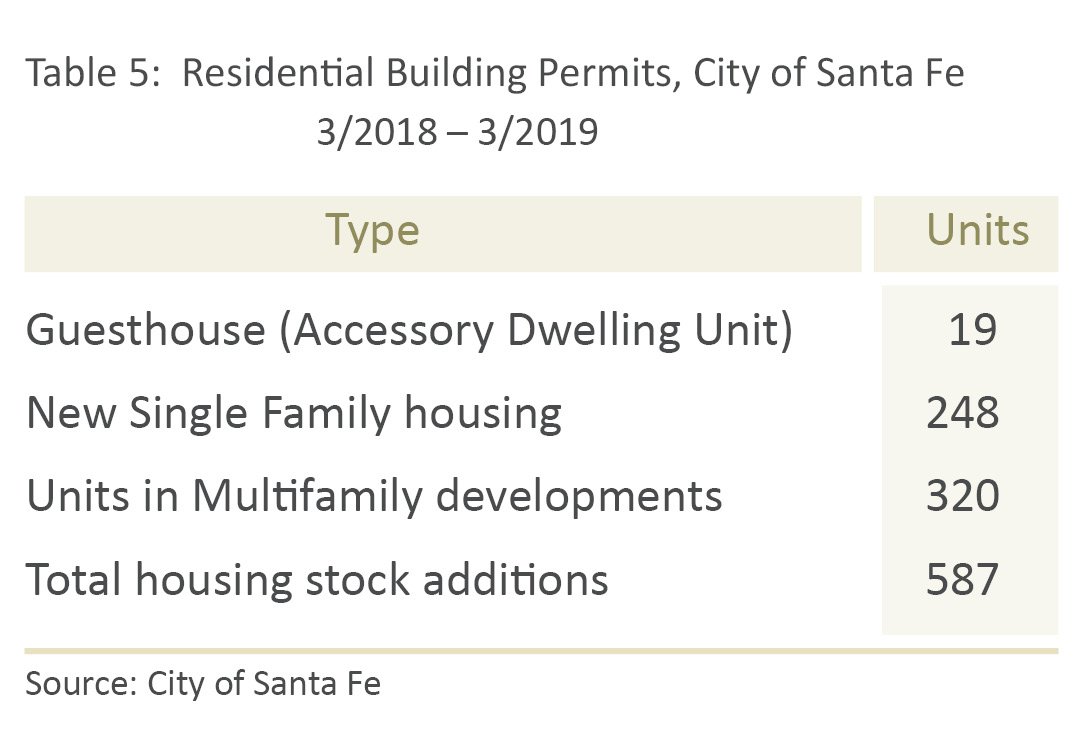

The City of Santa Fe permitted the construction of 587 new residential units in between March 2018 and 2019 (Table 5). During the same period, about 170 whole houses/apartments were added to the city’s inventory of STRs, diminishing net growth in the housing stock by about 29 percent.

Downtown and eastside property values and rents are already quite high and thus few low- or moderate-income Santa Fe residents are directly displaced by STR conversions. However, the loss of long term housing in affluent neighborhoods increases the demand for housing in other parts of the city, creating a domino effect that ultimately results in higher housing costs citywide.

The size of this impact is hard to pinpoint and likely varies by location. A recent national study found that every 1 percent increase in the number of STRs produces a .024 percent increase in rents and a .037 percent increase in housing prices. (5) Since December 2014, the number of STRs in Santa Fe has increased by an average of 50 percent per year. During that same period, rent for a single family home increased by an annual average of 4.9 percent and median home prices rose by an annual average of 10 percent. If Santa Fe follows the trend observed nationally, this level of STR growth would translate into a 1.2 percent annual increase in rents and a 1.8 percent annual increase in home prices over the four-year period.

Home prices and long-term rents both rose substantially between December 2014 and December 2018. Table 6 shows the percent growth in purchase price and monthly rents for single family homes in Santa Fe.

Accessory Dwelling Units

An accessory dwelling unit (ADU) is a second dwelling unit on the same property as the main house. The ADU is owned by the owner of the main house and the two houses cannot be bought or sold separately. When ADUs are used as long-term rentals (LTRs) they are additions to the housing stock that provide low density housing and alternatives to large scale apartment complexes.

ADUs constituted about 3 percent of new residential units permitted by the City of Santa Fe between March 2018 and March 2019 (Table 5). Increasing the number of ADUs used as long-term housing could help to increase the supply of housing available to Santa Fe residents. In a 2018 report, the Santa Fe Housing Action Coalition, a group of business interests and non-profits that includes many Santa Fe affordable housing providers, recommended that the City remove regulatory barriers to ADU construction by minimizing parking requirements when adequate on-street parking is available, allowing second story ADUs where permitted by zoning, permitting flexible setbacks and reducing lot coverage requirements, and eliminating owner-occupancy requirements for long-term rental units. (6)

While incentives to construct new ADUs or/and utilize ADUs as long-term rentals can help to increase Santa Fe’s housing supply, such policies, even if very successful, can make only a small dent in Santa Fe’s profound shortage of affordable housing and must therefore be part of a larger, more ambitious package of affordable housing reforms and investments.

RECOMMENDATIONS:

The results of this analysis have important policy implications for the City of Santa Fe. Although more stringent regulation of STRs may be called for at some point, rigorous enforcement of current law is an essential first step toward minimizing the negative impact of STRs and generating revenue with which to offset those effects.

Enforce registration requirements. Ensure that all active STRs are registered with the City by actively seeking out unregistered properties and levying fines for non-compliance.

Educate STR hosts about their obligation to pay both the Lodgers Tax and the Gross Receipts Tax, even if the platform(s) on which they list their properties cannot, or will not, automatically collect and remit one or both taxes. The City can improve GRT compliance by requiring STR hosts to supply a CRS number at registration and advising hosts of the correct NAICS code under which to report their STR gross receipts.

Invest in affordable housing. Additional revenue attributable to enforcement of the GRT and Lodgers tax should be dedicated to the City’s Affordable Housing Trust Fund. State law enacted in 2019 de-earmarked a number of municipal and county local option taxes, allowing local governments greater discretion in allocating GRT revenue. The City of Santa Fe can take advantage of this new flexibility to direct additional GRT revenue from STRs to affordable housing. (7) At the state level, rescinding property tax breaks for second homes can make taxes more equitable and generate additional revenue for affordable housing.

Reduce barriers to construction of affordable housing by:

Reducing compliance costs associated with permitting, impact fees and water rights.

Revising zoning standards to eliminate conflicting requirements and encourage development of mixed-used affordable housing projects.

Streamlining the development approval process to expedite affordable housing approvals while ensuring adequate community input.

Reducing barriers to ADU construction by amending the City’s ADU ordinance to:

Allow parking requirements to be met with on-street parking, when available.

Replace the current requirement that ADUs be “of the same architectural style as the main house” with the requirement that ADUs follow existing neighborhood design guidelines.

Allow for two-story casitas if already permissible in the neighborhood.

Discourage the use of ADUs for STRs by requiring that the homeowner live on the property.

Encourage the use of ADUs for long term rentals by eliminating owner-occupancy requirements for long-term rental units.

Support state legislative proposals that fund affordable housing and promote tax fairness:

Limit the 3 percent cap on annual valuation increases to owner-occupied homes so that the property tax on vacation homes and STRs is based upon true market value and tax burden is distributed more equitably.

Authorize local governments to impose an occupancy surtax on STRs to fund affordable housing.

Data Used in This Analysis

This analysis utilizes a property performance dataset purchased from AirDNA in March 2019. (8) AirDNA is a data analytics company that aggregates data from STR platforms using a process known as web scraping and uses algorithms to sort through the data and identify unique properties and STR hosts. The resulting data present a generally accurate picture of the STR market but can be somewhat imprecise at the individual property level. To enhance accuracy, estimates derived from the AirDNA data were cross-checked against aggregate results for the City of Santa Fe produced by Host Compliance, another major purveyor of STR data.

Additional data sources utilized in this report include the US Census American Community Survey (ACS), Zillow, New Mexico Taxation and Revenue Department, the Santa Fe County Assessor’s Office, and the City of Santa Fe Land Use Department. ACS data were used to estimate baseline housing supply. Data acquired from Zillow.com were used to track property values and rents over time. The Assessor’s Office provided data on all properties listed on the Santa Fe County tax rolls from 2015 through 2019. The City’s Land Use Department provided access to the STR registry and provided a listing of residential building permits issued since 2014.

Notes

1 Note that collections of GRT in Table 3 reflect only the City’s 36 percent share of GRT revenue generated within city limits.

2 3-28-21 NMSA 1978

3 S.B. 7, 54th Legislature, 2019 Reg. Sess. (NM) Bill text and analysis available at: https://www.nmlegis.gov/Legislation/Legislation?Chamber=S&LegType=B&LegNo=7&year=19

4 The Census Bureau classifies homes that are not a primary residence as vacant.

5 Barron, K., Kung, E. and Proserpio, D., The Sharing Economy and Housing Affordability: Evidence from Airbnb (March 29, 2018). Available at SSRN: http://dx.doi.org/10.2139/ssrn.3006832

6 Santa Fe Housing Action Coalition (2018) Casitas Build Community Accessory Dwelling Unit Regulatory Recommendations. Retrieved from: https://santafehousingaction.org

7 2019 N.M. Laws, ch. 274.

8 https://www.airdna.co/custom-vacation-rental-reports

Funding for this report provided by the Thornburg Foundation

505.467.7853 I 2300 N. Ridgetop Rd., Santa Fe, NM 87506

www.thornburgfoundation.org