Inflation Resilience

KELLY O’DONNELL, PH.D. | CHIEF RESEARCH AND POLICY OFFICER, HOMEWISE

In June 2022, the US inflation rate hit a 40-year high of 9.1 percent. Price growth has slowed a bit since then, averaging 8.5 percent in August, but prices are still rising faster than they have since 1981.

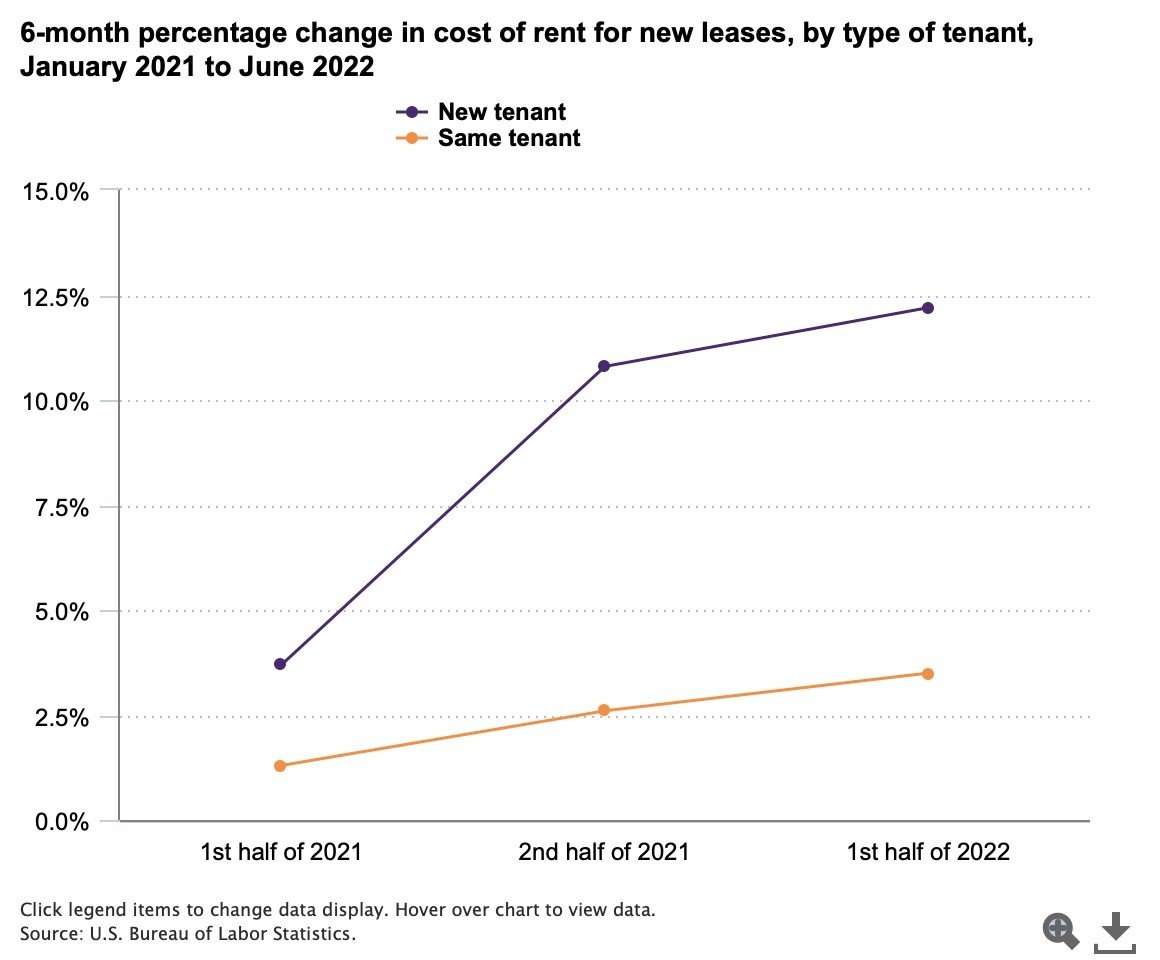

As inflation rises, the cost of everything, including real estate, goes up. Nationally, in the first half of 2022, average rents for new leases increased 12.2 percent. And the price hikes weren’t confined to households on the move. Average rents for tenants who had renewed their leases within the last 6 months increased 3.5% during the same period. These averages disguise the true extent of the problem, particularly in smaller municipalities and previously affordable cities in the Sun Belt and Midwest favored by newly remote workers. Cities like Cleveland, Tampa, and Phoenix have seen rents spike by as much as 40% in a single year.

While inflation tends to increase wages along with prices, the gap between wage growth and housing cost growth is higher than ever, making housing even more unaffordable. For example, Cleveland, widely seen as affordable, has seen the average price of a square foot of real estate jump 134 percent in five years, while average wages grew by 37 percent.

Because inflation eats away at the value of money, savings accounts diminish in value when inflation is high. Households that want to preserve the value of their savings must invest them in assets that appreciate faster than inflation. With the stock market volatile and falling, real estate is one of the few asset classes to which American households have ready access that has the potential to outpace inflation.

Typically, homes appreciate at an average rate of 3 to 5 percent annually, a relatively modest rate but still much higher than the earnings on a typical savings account. Homeowners are also far less vulnerable to the negative impacts of inflation than renters because their house payment, typically the largest component of family budget, is largely fixed, while rents respond, usually within one year, to overall wage and price increases. It is critical to point out that economically vulnerable renter households are disproportionately young, low income, Hispanic and/or African American.

Unfortunately, homebuying also gets more expensive during inflationary periods, due to escalating prices for labor, land, and materials and because the federal government combats inflation by increasing interest rates, something it has already done five times this year.

As of September 23, 2022, the average rate on a 30-year fixed mortgage stood at 6.67%, according to Bankrate.com. With another hike in the federal funds rate widely anticipated, interest on newly originated mortgages could easily hit 7% by year’s end.

And the housing market is responding. While prices are still sky-high, they are no longer offset by record-low interest rates. Houses are sitting on the market far longer than they did even earlier this year and many would-be sellers are waiting until things “calm down a bit” before putting their homes on the market, further constricting an already inadequate housing supply. While market forces could push home prices down if interest rates remain high, that is little consolation to a family that is house hunting now.

Households looking to buy a house as a way to preserve the value of their assets in the face of runaway inflation are at a disadvantage, particularly relative to households that purchased a year ago when mortgage interest rates averaged 2.88%, less than half what they are now.

Households that entered into a low-interest, fixed-rate mortgage a year ago locked in an affordable housing payment that will remain relatively stable for the next few decades or until they sell, regardless of the direction inflation or interest rates take, all while the value of their property continues to rise and their equity grows. It is worth noting that even homes purchased at the peak of the housing market, right before the 2008 recession, are worth much more now than they were then.

But what about people who want to buy now? Should they resign themselves to sky-rocketing rents while waiting for interest rates to go down? Not necessarily. Buying now still makes sense for many households who currently rent. While the monthly mortgage payment on the median-priced US home has gone up about $400 in the last year, according to REDFIN, national median asking rents climbed $264 in the same period, surpassing $2,000/month for the first time in May 2022, and owning remains more affordable than renting for many households.

Even households that pay a little more each month to switch from renting to owning are very likely to experience a net reduction in housing costs within a handful of years as the rent on their former apartment continues to climb while the mortgage payment on their home remains fixed. Households that buy today can also refinance for a lower payment when interest rates inevitably fall, another attractive option unavailable to those who remain in rentals.